- Urban 411

- Posts

- Rate Hikes Coming?

Rate Hikes Coming?

Half of big banks see rate hikes by 2027, developers sit on record inventory and the vacancy tax is being questioned.

Today, we’re covering

🏦 Where Will Rates Go Next?

📦 Developers Stuck With Record Inventory

📉 Nova Scotia Leads Canada’s Price Drop

👷🏽 Trades Jobs Pile Up in Calgary

❓ Is Toronto’s Vacancy Tax Working?

😲 WTF of The Week

Read Time: 5 minutes

🏦 Where Will Rates Go Next?

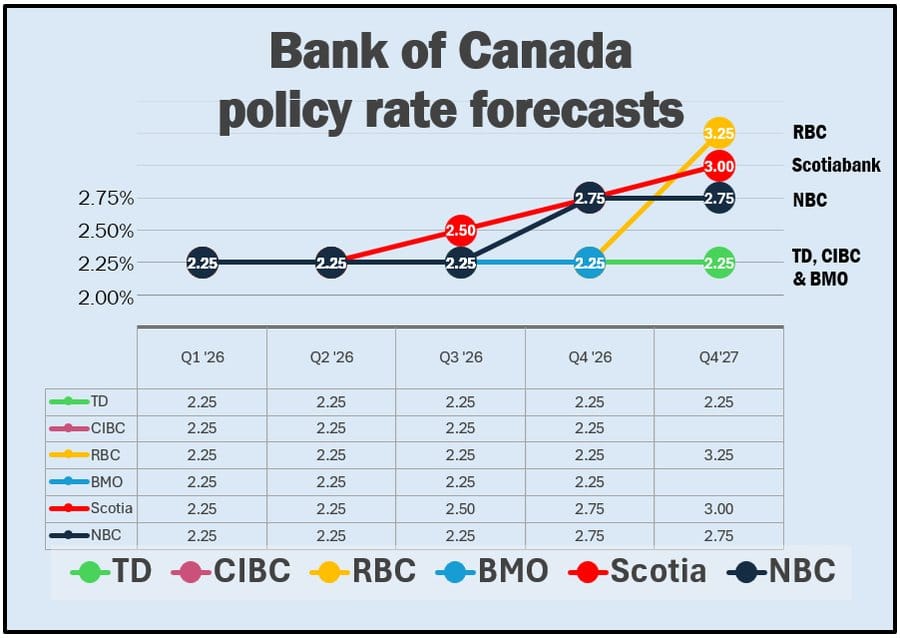

Source: Canadian Mortgage Trends

The 411: Canada’s biggest banks now agree on one thing and disagree on the part that matters most. While all six expect the Bank of Canada to hold at 2.25% through 2026, they are split down the middle on what comes next.

All Big 6 banks forecast the BoC policy rate holding at 2.25% through 2026

The split begins in 2027, with no clear consensus on direction

3 of 6 banks expect rate hikes once the easing cycle ends:

National Bank: First hike by late 2026, rising to 2.75%

Scotiabank: Gradual increases, reaching 3.00% by end-2027

RBC: Most aggressive outlook, calling for 3.25% by Q4 2027

3 of 6 banks expect rates to stay flat at 2.25% through 2027:

TD, CIBC, BMO

Variable-rate mortgages and HELOCs remain directly exposed to these outcomes through the prime rate

A 25-bp rate move typically changes monthly payments by ~$12.50 per $100,000 of mortgage debt

📊 What do you think happens next with BoC rates? |