- Urban 411

- Posts

- These Canadian Cities Are Still Seeing Price Gains

These Canadian Cities Are Still Seeing Price Gains

Not all Canadian real estate markets are experiencing a cooling trend. In fact, some cities are quietly climbing.

Today, we’re covering

🏆Canada’s Winning and Losing Housing Markets

🦅 Canadians Losing Interest in U.S. Homes

😔 Another Brampton Real Estate Scammer Just Surfaced

🤑 From Condo to House? That'll Be $647K More

🤔 WTF of The Week: "But My Building Allows Airbnb!"

Read Time: 4 minutes

🏆Canada’s Winning and Losing Housing Markets

National home prices in Canada rose 0.3% year-over-year in Q2 2025 but fell 0.4% from Q1, indicating a mostly flat spring market

Toronto and Vancouver saw year-over-year price drops of 3.0% and 2.6%

Prices rose significantly in Edmonton (7.5%), Montreal (3.5%), Regina (3.5%), Halifax (3.4%) and Winnipeg (3.1%)

Quebec City saw a 13.5% price increase due to low inventory

Edmonton, Halifax, Quebec City, and Regina are expected to see 7%+ gains by end of year, while Toronto and Vancouver are projected at 2% and 1.5%

Why This Matters: Growth opportunities exist in cities with tight inventory and rising demand like Quebec City, Edmonton, and Halifax. Slower national growth means returns will vary widely by region, and local fundamentals matter more than ever. (source)

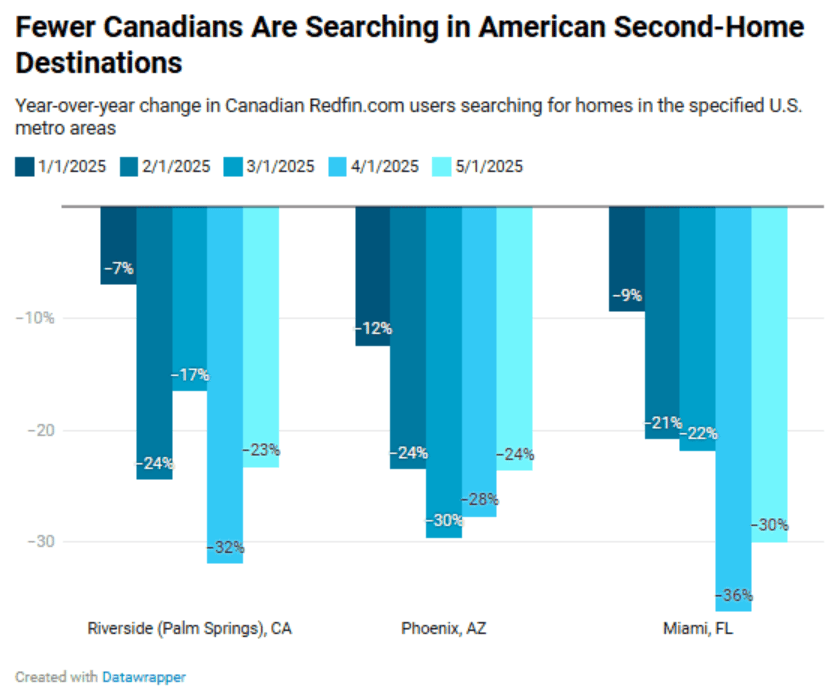

🦅 Canadians Losing Interest in U.S. Homes

Canadian interest in U.S. real estate dropped nearly 30% in May 2025, according to Redfin.

Canadians were the top foreign buyers in 2024, accounting for 13% of all foreign U.S. real estate purchases, with a total expenditure of USD 5.9 billion.

The decline began in February, coinciding with the escalation of U.S.-Canada trade tensions and the introduction of a new round of 25% tariffs.

A weak Canadian dollar has further strained affordability for Canadians in the already high-priced U.S. market.

Top cities with the most significant search declines: Houston (-55%), Philadelphia (-53%), Chicago (-47%), and Miami (-30%).

Why This Matters: Canadians have long been a significant source of foreign demand in U.S. real estate, particularly in snowbird hotspots such as Florida and Arizona. But political hostility, new tariffs, rising climate risks, and a weak loonie are shifting sentiment fast. A 30% drop in search traffic isn’t just optics — it’s a signal that the cross-border real estate bond is cracking.

📊 Would you invest in real estate in the United States? |

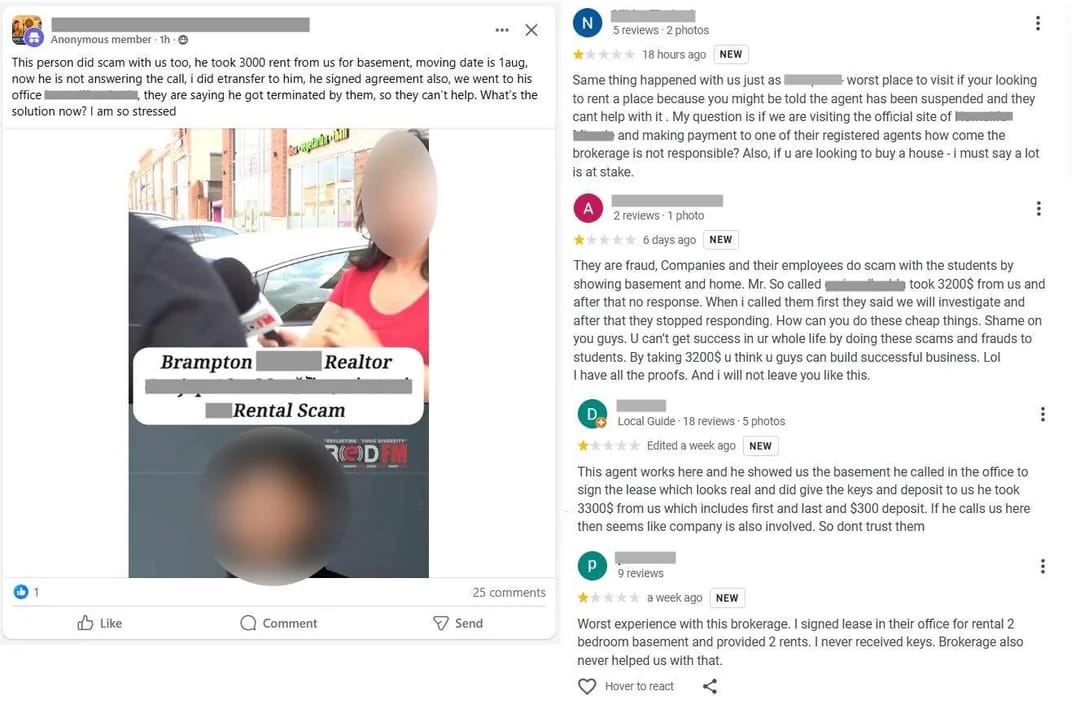

😔 Another Brampton Real Estate Scammer Just Surfaced

Real estate scams are becoming rampant in Brampton, with multiple cases surfacing involving fake rentals and fraudulent home sales

We previously covered the story of Moiz Kunwar, who was charged with defrauding buyers through a fake pre-construction scheme

Since that post, dozens more alleged victims have come forward claiming Kunwar took deposits for homes he had no legal right to sell

Peel police have laid additional criminal charges and issued a public warning to avoid any transactions with Kunwar

Meanwhile….

New complaints are emerging about a different alleged scam, also in Brampton, involving fake rental agreements

Victims say they signed leases for basement units, transferred thousands of dollars, and never received keys

Multiple online reviews and social posts accuse the agent and brokerage of taking money and ghosting tenants

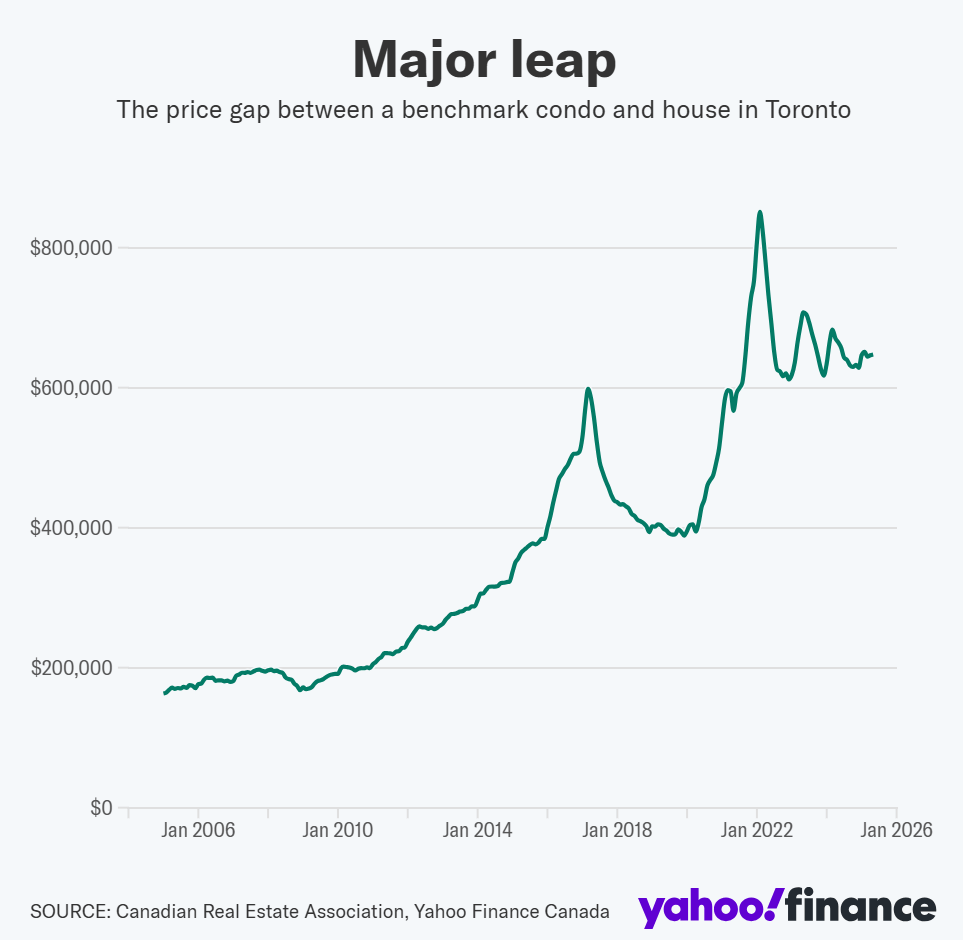

🤑 From Condo to House? That'll Be $647K More

Nationally, buying a house costs 52–55% more than buying a condo.

Toronto’s price gap peaked at $851K in 2022, but has since narrowed to $647K still out of reach for many “move-up” buyers.

Montreal’s gap is around $242K, but in Vancouver, it’s a jaw-dropping $1.2M+, 5× larger.

Since 2005, the condo-house gap has consistently widened in absolute dollars, making it harder for middle-class Canadians to grow into larger homes.

Overall, the cost to upgrade from a condo to a house has become more volatile, especially post-2020, driven by interest rates, inflation, and population trends.

Why This Matters: For many families, upgrading from a condo to a house is now financially out of reach, especially in cities like Vancouver and Toronto, where the price gap exceeds 100%. Add hidden costs like land transfer taxes, realtor fees, movers, and legal expenses, and the dream of “moving up” starts to vanish.

🤔 WTF of the Week: $1M Loss in Yorkville?!

Someone dropped $4.1M on a Yorkville penthouse, and now it’s back on the market for $3.12M — a nearly $1M haircut before the keys were even handed over. The listing doesn’t just show a price drop; it hints at something deeper: maybe the numbers never made sense to begin with. Was the original price just peak-market delusion, or are we finally seeing a dose of reality?

📊 Do you think the original $4.1M price tag was ever justified? |

🛠 Our Trusted Providers

Tired of dealing with riff-raff service providers in real estate? These are our Trusted Providers, handpicked by Urban 411 so you can leave the guesswork at the door.

Zown

Empowering Canadian home buyers with innovative solutions.

Zown is reshaping the home-buying journey with offering 1.5% cash back on purchases. Their growing realtor network also enables licensed agents to unlock additional income while providing unmatched value to homebuyers.

👉 See Zown’s Offering

Atena Construction Group

Turn your backyard into an income stream & increase your property value

With over 30 years of experience in the GTA, Atena Construction specializes in building laneway and garden suites—helping homeowners unlock new income streams and boost their property's value. 👉 Learn More About Atena Construction

Cardinal Law

The law firm for real estate investors in Ontario

Virtual, paperless, and secure for stress-free REI and private lending deals. Urban 411 members get a free corporate structure review, free will & estate plan review, plus 10% off any related work. 👉 Learn More About Cardinal Law

LandingLift

Elevate your real estate listings with affordable, done-for-you landing pages.

LandingLift creates stunning, fully customized websites that turn your listings into powerful sales tools. Utilizing AI-powered content and expert design, they deliver high-quality landing pages optimized for both SEO and mobile devices.

👉 Get 40% off your first order

HomeAbroad

Your One-Stop Solution for Canadian Investments in U.S. Real Estate

Unlock the U.S. property market with HomeAbroad’s 30-year fixed-rate mortgages, tailored specifically for Canadian investors! With no need for a U.S. credit history, you can qualify based on the property’s income rather than personal income or assets. Start your U.S. investment journey with ease. 👉 Get a Free Mortgage Rate Quote Now

What did you think of this week's newsletter? |