- Urban 411

- Posts

- Trust Issues in Canada’s Housing Market

Trust Issues in Canada’s Housing Market

Another real estate scandal hits Ontario, office demand climbs, and governments face multi-billion-dollar losses.

Today, we’re covering

🧑🏼⚖️ Yet Another Scandal: This Time, a Lawyer

📉 Canada’s Rental Chill Deepens

🏚️ Canada’s Real Estate Bubble Is Unraveling

🫣 Mortgage Trouble on the Rise

💻 How AI Shields Commerical Real Estate from Tariffs

😲 WTF of The Week

Read Time: 4 minutes

🧑🏼⚖️ Yet Another Scandal: This Time, a Lawyer

The 411: A Toronto real estate lawyer turned her trust account into a personal piggy bank, and no one caught on for months. Singa Bui’s alleged $7M scheme funded luxury trips, designer gear, and private school bills while regulators snoozed. Now she’s facing 60+ criminal charges and a long list of furious clients.

Toronto real estate lawyer Singa Bui (Cartel & Bui LLP) is accused of misappropriating millions from her firm’s trust account to fund a lavish lifestyle.

Despite clear red flags, including $138,000 in trust account funds used for an Amex bill and $2,000 for a daycare payment, the Law Society’s 2022 audit raised no concerns.

The LSO took seven months to investigate after receiving a complaint, then another five months to suspend the firm.

Clients were given shifting explanations (bank access issues, medical emergencies)

Bui admitted she used client funds for “luxurious vacations,” private-school tuition, and designer goods.

Civil suits from 20+ plaintiffs alleging $7M+ missing; in Oct 2024, Bui and Cartel were found in contempt for non-compliance (e.g., records, passport)

In 2025, police laid criminal charges for 42 counts of fraud, 17 criminal breach of trust, and one count of proceeds of crime.

Why This Matters: Trust accounts are meant to be the safest place for client money, but they are proving vulnerable under a system that relies on self-reporting and “spot audits” that rarely catch fraud. With real-estate lawyers handling billions each year, the public can’t afford to trust a system built on presumed honesty instead of proactive protection.

🏚️ Canada’s Real Estate Bubble Is Unraveling

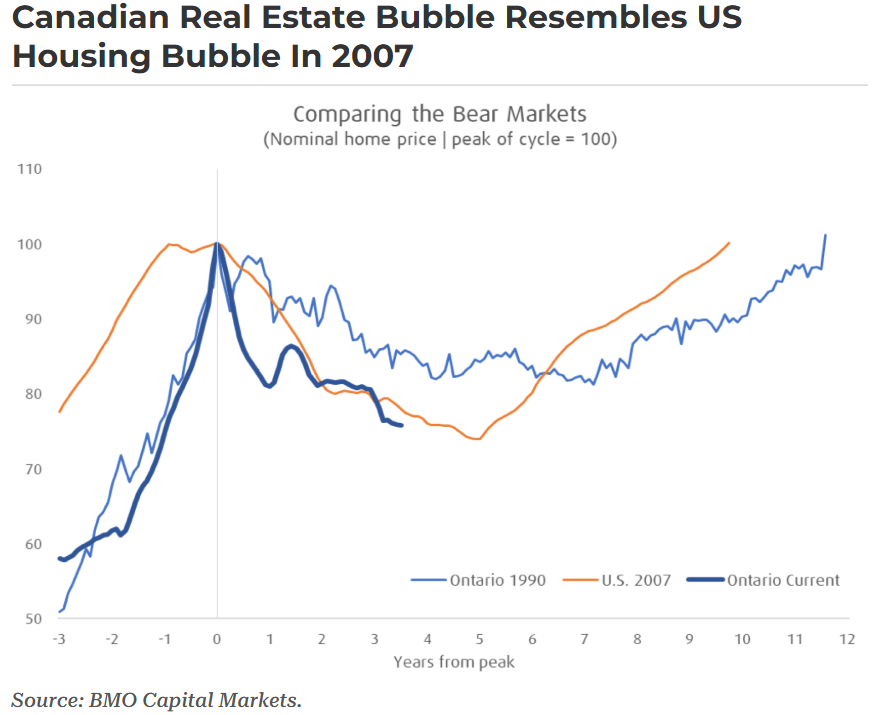

The 411: BMO says the housing bubble’s already burst, and we’re living through the fallout. Prices have been sliding since 2022, with no quick rebound in sight. The bank warns it could take years to recover as the post-pandemic frenzy fizzles and Ontario’s slump drags the rest of Canada down.

BMO says Canada’s housing bubble already popped and prices have been falling since early 2022.

The correction now mirrors the U.S. 2007 housing crash and Ontario’s 1990s downturn.

Home prices have declined for over three years, despite record population growth.

BMO warns the recovery will take years, possibly another five.

The bank calls it “next to impossible” to recreate the mix of factors that fueled the boom. (ultra-low rates, pandemic migration, peak Millennial demand)

Ontario’s decline is expected to spread to other markets, given its outsized economic influence.

Why This Matters: Prices have been falling for three years, and BMO says the pattern now mirrors the U.S. housing crash of 2007. The mix of cheap credit, record immigration, and pandemic-era speculation that fueled the boom is gone, leaving a slower, harder recovery ahead.

📉 Canada’s Rental Chill Deepens

The 411: For the first time in years, rents are actually falling — and not just by a little. Average asking prices dropped 3.2% in September, marking a full year of declines. With new supply flooding in, renters are finally getting a breather, but analysts warn it won’t last long once demand roars back.

Average asking rents in Canada fell 3.2% year-over-year in September to $2,123, marking the 12th straight month of annual declines.

Purpose-built apartments: down 2.1% to $2,093.

Condo apartments: down 3% to $2,226.

Houses and townhomes: down 5.5% to $2,178.

Vancouver and Toronto rents are now at their lowest levels in nearly four years, according to Urbanation.

Major city trends:

Vancouver −8.2% ($2,776)

Calgary −7.4% ($1,897)

Toronto −2.9% ($2,592)

Edmonton −2.3% ($1,573)

Ottawa −1.3% ($2,190)

Montreal −0.5% ($1,981)

Why This Matters: A surge in new supply is easing pressure, but experts warn this window of relief may close fast once population growth and condo tightening kick back in. For investors and policymakers, it’s a reminder that supply imbalances, not just interest rates, drive affordability.

(source)

🫣 Mortgage Trouble on the Rise

The 411: Mortgage trouble is spreading fast. Canada’s delinquency rate has jumped 64% since 2022, and nearly half of that spike hit just last quarter.